Showing 76 items matching "interest rates"

-

Flagstaff Hill Maritime Museum and Village

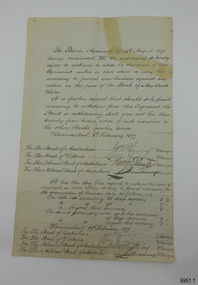

Flagstaff Hill Maritime Museum and VillageDocument - Financial agreement, Bank of Australasia et al, Banks' Agreement, 5-2-1877 to 15-5-1878

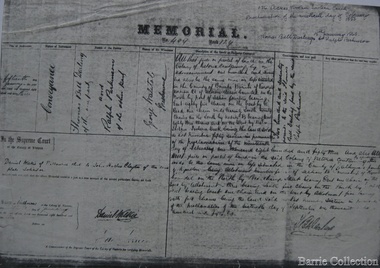

... interest rates... not to exceed the stated rates of interest. The first section... to Warrnambool and the district. It specifies interest rates for fixed... Managers not to exceed the stated rates of interest. The first ...This Banks' Agreement refers to one of several agreements made between the Warrnambool and district bank Managers not to exceed the stated rates of interest. The first section of the Agreement is dated 5th February 1877 and the last date is 15th May 1879. The Banks agreed to specific interest rates for fixed deposits and the terms of those deposits. The first page refers to a previous Agreement being terminated on 14th August 1875. A document from the ANZ Bank, Melbourne, refers to another Agreement dated 2nd April 1879. A transcription of the Banks' Agreement is attached to this record. The four banks subscribing to the Agreement are: - Bank of Australasia Bank of Victoria Colonial Bank of Australasia National Bank of Australasia The Bank of Australasia was incorporated by the Royal Charter of England in March 1834. The bank began in Australia on 14th December 1835, opening in Sydney. The Acting Superintendent of the bank at that time was David Charters McArthur. He was Superintendent from 1867 to 1876. The Melbourne branch opened on 28th August 1838 in a two-roomed brick cottage on the north side of Little Collins Street, where two huge mastiff dogs were used at night to guard the bank. The government also provided an armed military sentinel. Due to the bank's rapid growth, a new building for the Melbourne branch was opened in 1840 at 75 Collins Street West. By 1879 the bank had been upgraded to a magnificent two-storey building on the corners of Collins and Queens Streets, with the entry on Collins Street. In 1951 the Bank of Australasia amalgamated with the Union Bank to form Australia and New Zealand Bank, now known as the ANZ. Then in 1970, the ANZ merged with both the ES&A and the London Bank of Australia to form the ANZ Banking Group Limited. The ANZ Banking Group Ltd kindly donated various historic items from the Bank of Australasia. BANK of AUSTRALASIA, WARRNAMBOOL – In 1854 Warrnambool had two banks, the Union Bank and the Bank of Australasia. Later, completely different bank businesses opened; in 1867 the National Bank of Australasia, then in 1875 the Colonial Bank of Australasia. The original Warrnambool branch of the Bank of Australasia was established in July 1854, and operated from a leased cottage on Merri Street, close to Liebig Street. The bank later bought a stone building previously erected by drapers Cramond & Dickson on the corner of Timor and Gibson Streets. Samuel Hannaford was a teller and then Manager at the Warrnambool branch from 1855 to 1856 and the Warrnambool Council chose that bank for its dealings during 1856-57. In 1859 Roberts & Co. was awarded the contract to build the new Bank of Australasia branch for £3,000. The land was on a sand hill on the northeast corner of Timor and Kepler Streets and had been bought in 1855 by investor James Cust. The new building opened on May 21, 1860. The bank continued to operate there until 1951 when it merged with the Union Bank to form the ANZ Bank, which continued operating from its Liebig Street building. Warrnambool City Council purchased the former Bank of Australasia building in 1971 and renovated it, then on 3rd December 1973 it was officially opened as the Art Gallery by Cr. Harold Stephenson and Gallery Director John Welsh. The Gallery transferred to the purpose-built building on Liebig Street in 1986 and the old bank building is now the Gallery Club. Staff at the Bank of Australasia in Warrnambool included the following men but others were also involved: Samuel Hannaford, Teller then Manager from 1855-1856; W H Palmer, Manager from January 1857 until November 1869 when the Teller Basil Spence was promoted to Manager; H B Chomley, Manager from April 1873 and still there in 1886; A Butt, Manager in 1895-1904; J R McCleary Accountant and Acting Manager for 12 months, until 1900; A Kirk, Manager 1904; J Moore, staff until his transfer to Bendigo in December 1908; J S Bath was Manager until 1915; C C Cox, Manager until April 1923; Richard C Stanley, Manager 1923 to April 1928. This Banks' Agreement has historical significance as it belonged to the Bank of Australasia which was established in Australia in 1835 by Royal Charter. One of the four parties of the Agreement was the Warrnambool branch, so the document is also a historical record of the financial agreements between similar institutions in the local area. The document is significant for its association with the Bank of Australasia in Warrnambool, the first bank in Warrnambool, established in 1854. The bank continued to operate until its merger in 1951 when it became the ANZ Bank, which is still in operation today. The Bank was an integral part of the establishment and growth of commerce in Colonial Warrnambool and throughout Australia.Document titled the Banks Agreement; a four-page document handwritten in black ink with a nib pen on heavy cream-coloured paper. The document describes the agreement between four banks local to Warrnambool and the district. It specifies interest rates for fixed deposits, the period of the deposits and the penalty for early withdrawal. It includes banks in Warrnambool, Belfast (now Port Fairy) and Koroit and is dated from February 1877 to May 1878. It has been signed by the Banks' Managers. The contents are an agreement not to exceed the stated rates of interest. This copy belonged to the Bank of Australasia, Warrnambool."Banks' Agreement" "Warrnambool" "Belfast" "Koroit" "5th February 1877" "17th February 1877" "16th May 1877" "6th May 1878" "14th May 1878" "15th May 1878"flagstaff hill, warrnambool, flagstaff hill maritime museum, maritime museum, commerce, banking, bank of australasia, australia & new zealand bank, anz bank, david charters mcarthur, banks' agreement, bank of victoria, colonial bank of australasia, national bank of australasia, belfast (now port fairy), koroit, fixed term deposits, interest rates, 1877, 1878, bills, promissory notes, current accounts -

Bendigo Historical Society Inc.

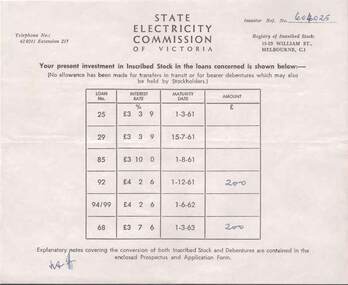

Bendigo Historical Society Inc.Document - L. PROUT COLLECTION: STATE ELECTRICITY COMMISSION OF VICTORIA

... concerned is shown below: a table with the different loans, interest...: a table with the different loans, interest rate, maturity date ...State Electricity Commission of Victoria. Investor ref. no. 604025, your present investmernt in iscribed stock in the loans concerned is shown below: a table with the different loans, interest rate, maturity date, amount follows.organization, public utility, electricity company -

Flagstaff Hill Maritime Museum and Village

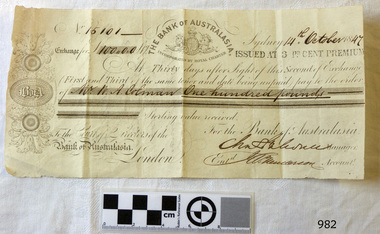

Flagstaff Hill Maritime Museum and VillageCurrency - Bank exchange note, Perkins, Bacon and Perch, 14-10--1847

... 1847 at the Sydney branch. The interest rate was three per cent..., the receiving person, signatures and a stamp with the interest rate.... October 1847 at the Sydney branch. The interest rate was three per ...This exchange note was issued by the Bank of Australasia to Mr N A Coleman for one hundred pounds paid n 14th October 1847 at the Sydney branch. The interest rate was three per cent. This exchange note displays the insignia of the Bank of Australasia, which was incorporated by Royal Charter of England in March 1834. The bank began in Australia on 14th December 1835, opening in Sydney. The Acting Superintendent of the bank at that time was David Charters McArthur. He was Superintendent from 1867-to 1876. The Melbourne branch opened on 28th August 1838 in a two-roomed brick cottage on the north side of Little Collins Street, where two huge mastiff dogs were used at night to guard the bank. The government also provided an armed military sentinel. Due to the bank's rapid growth, a new building for the Melbourne branch was opened in 1840 at 75 Collins Street West. By 1879 the bank had been upgraded to a magnificent two-storey building on the corners of Collins and Queens Streets, with the entry on Collins Street. In 1951 the Bank of Australasia amalgamated with the Union Bank to form the Australia and New Zealand Bank, now known as the ANZ. Then in 1970, the ANZ merged with both the ES&A and the London Bank of Australia to form the ANZ Banking Group Limited. The ANZ Banking Group Ltd kindly donated a variety of historic items from the Bank of Australasia. BANK of AUSTRALASIA, WARRNAMBOOL – In 1854 Warrnambool had two banks, the Union Bank and the Bank of Australasia. Later, completely different bank businesses opened; in 1867 the National Bank of Australasia, then in 1875 the Colonial Bank of Australasia. The original Warrnambool branch of the Bank of Australasia was established in July 1854, and operated from a leased cottage on Merri Street, close to Liebig Street. The bank next bought a stone building previously erected by drapers Cramond & Dickson on the corner of Timor and Gibson Streets. Samuel Hannaford was a teller and then Manager at the Warrnambool branch from 1855 to 1856 and the Warrnambool Council chose that bank for its dealings during 1856-57. In 1859 Roberts & Co. was awarded the contract to build the new Bank of Australasia branch for the sum of £3,000. The land was on a sand hill on the northeast corner of Timor and Kepler Streets and had been bought in 1855 from investor James Cust. The new building opened on May 21, 1860. The bank continued to operate there until 1951 when it merged with the Union Bank to form the ANZ Bank, which continued operating from its Liebig Street building. Warrnambool City Council purchased the former Bank of Australasia building in 1971 and renovated it, then on 3rd December 1973 it was officially opened as the Art Gallery by Cr. Harold Stephenson and Gallery Director John Welsh. The Gallery transferred to the purpose-built building in Liebig Street in 1986 and the old bank building is now the Gallery club. Staff at the Bank of Australasia in Warrnambool included the following men but others were also involved: Samuel Hannaford, Teller then Manager from 1855-1856; W H Palmer, Manager from January 1857 until November 1869 when the Teller Basil Spence was promoted to Manager; H B Chomley, Manager from April 1873 and still there in 1886; A Butt, Manager in 1895-1904; J R McCleary Accountant and Acting Manager for 12 months, until 1900; A Kirk, Manager 1904; J Moore, staff until his transfer to Bendigo in December 1908; J S Bath was Manager until 1915; C C Cox, Manager until April 1923; Richard C Stanley, Manager 1923 to April 1928. The bank exchange note has significance through its association with the Bank of Australasia. The early Australian bank was established in 1834 by Royal Charter and opened in Sydney, Australia, in Sydney in 1835. The bank had many Australian offices in November 1877, particularly on the east and south coasts. Victoria had 45 percent of all Offices. The object is locally significant for its association with the Warrnambool Bank of Australasia, which was established in 1854. It was Warrnambool Council’s first bank. The bank continued to operate until the organisation's merger in 1951 when it became the ANZ Bank Group today. The Bank was an integral part of the growth of local commerce and the community.Bank exchange note for the Bank of Australasia, Sydney, manufactured by Perkins, Bacon and Perch, printed in brown. Insignia depicts a heraldic shield with a lion and unicorn on either side and another insignia with "B of A". Exchange note paid on 14th October 1847. Issued for one hundred pounds and paid to Mr N A Coleman.. Inscriptions include the document number, the date, the amount paid, the receiving person, signatures and a stamp with the interest rate.Handwritten number "15101" "One hundred pounds" "14th October [18] 47" "Mr N A Coleman" Black stamp "ISSUED AT 3 PR CENT PREMIUM" Signatures of [Manager] and [Accountant].flagstaff hill, warrnambool, shipwrecked-coast, flagstaff-hill, flagstaff-hill-maritime-museum, maritime-museum, shipwreck-coast, flagstaff-hill-maritime-village, banknote, currency, exchange note, commerce, banking, finances, bank of australasia, n a coleman, 1847, shipwrecked coast, flagstaff hill maritime museum, maritime museum, shipwreck coast, flagstaff hill maritime village, great ocean road, boa, union bank, australia & new zealand bank, anz bank, david charters mcarthur, d c mcarthur, sydney, new south wales, legal tender -

Ringwood and District Historical Society

Ringwood and District Historical SocietyReceipt Books, North Ringwood Maroondah Hospital Auxiliary financial records and documents - 1967 to 1981, 1967-1981

... . Interest rate was 17% in 1982.... - one for $1,000 and one for $3,112.19. Interest rate was 17 ...Collection of note books and papers belonging to the North Ringwood Maroondah Hospital Auxiliary funds. Bank deposit books and record of term deposits - one for $1,000 and one for $3,112.19. Interest rate was 17% in 1982.Small Landseer note book - receipts and expenditure for the North Ringwood Maroondah Hospital Auxiliary 1967-1981; 3 RESI-Statewide Building Society deposit books; 2 term deposit notes for N.R.H.A. dated 1982 -

Bendigo Historical Society Inc.

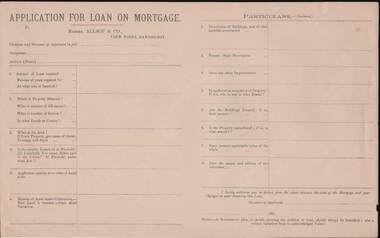

Bendigo Historical Society Inc.Document - KELLY AND ALLSOP COLLECTION: APPLICATION FOR LOAN ON MORTGAGE

... , occupation, amount of Loan, number of years, interest rate, Where... of years, interest rate, Where, number of Allotment, Section ...Application for Loan on Mortgage. Messrs Allsop & Co., View Point, Sandhurst. Application has space for name, occupation, amount of Loan, number of years, interest rate, Where, number of Allotment, Section, parish or County, Area, Leasehold or Freehold. Applicants opinion as to value of Land alone. Number of Acres under Cultivation. How Land is watered. State Shire Valuation, Description of Buildings and materials used, Fences, Improvements. Application for Loan on Mortgage. Messrs Allsop & Co., View Point, Sandhurst. Application has space for name, occupation, amount of Loan, number of years, interest rate. Where, number of Allotment, Section, parish or County, Area, Leasehold or Freehold. Applicants opinion as to value of Land alone. Number of Acres under Cultivation. How Land is watered, State Shire Valuation, Description of Buildings and materials used, Fences, Improvements. Is applicant in occupation of Property, if not who is, and at what Rental. Are Buildings Insured, if so, what amount. Is the Property encumbered, is so, to what amount. Present marketable value of the whole, and names and addresses of two references. Authorization to deduct from the advance the costs of the Mortgage and Charges on obtaining the Loan. Note at the end - A Government plan, or sketch showing the position of the land and written valuation from an acknowledged Valuer. On the back is space for a Valuator's Report and a note to the Valuators, also a Proposal for Loan on Mortgage with details of the loan. Date on the form is 188-.business, stockbroker, kelly & allsop, kelly and allsop collection - application for loan on mortgage, allsop & co. -

Federation University Historical Collection

Federation University Historical CollectionPhotograph - Photograph - Colour, E.J. Barker Library Social Distancing During the Covid19 Pandemic, 2020, 06/04/2020

... the first central bank to cut interest rates in response... central bank to cut interest rates in response to the outbreak ...On 12 January, the World Health Organization (WHO) confirmed that a novel coronavirus was the cause of a respiratory illness in a cluster of people in Wuhan City, Hubei Province, China, who had initially come to the attention of the WHO on 31 December 2019. On 3 March, the Reserve Bank of Australia became the first central bank to cut interest rates in response to the outbreak. Official interest rates were cut by 0.25% (25 base points) to a record low of 0.5%. On 12 March, the Federal Government announced a A$17.6 billion stimulus package, the first since the 2008 GFC. he package consists of multiple parts, a one-off A$750 payment to around 6.5 million welfare recipients as early as 31 March 2020, small business assistance with 700,000 grants up to $25,000 and a 50% wage subsidy for 120,000 apprenticies or trainees for up to 9 months, 1 billion to support economically impacted sectors, regions and communities, and $700 million to increase tax write off and $3.2 billion to support short-term small and medium-sized business investment. On 16 March, Premier Dan Andrews and Minister for Health Jenny Mikakos declared a state of emergency for Victoria for at least four weeks. On 19 March, the Reserve Bank again cut interest rates by a further 0.25% to 0.25%, the lowest in Australian history. On 22 March, the government announced a second stimulus package of A$66bn, increasing the amount of total financial package offered to A$89bn. This included several new measures like doubling income support for individuals on Jobseeker's allowance, granting A$100,000 to small and medium-sized businesses and A$715 million to Australian airports and airlines. It also allowed individuals affected by the outbreak to access up to A$10,000 of their superannuation during 2019–2020 and also being able to take an additional same amount for the next year. on the same day Victorian Premier Daniel Andrews announced on 22 March that the state will bring the school holiday forwards to 24 March from 27 March. On 30 March, the Australian Federal Government announced a $130 billion "JobKeeper" wage subsidy program offering to pay employers up to $1500 a fortnight per full-time, part-time or casual employee that has worked for that business for over a year. For a business to be eligible, they must have lost 30% of turnover after 1 March of annual revenue up to and including $1 billion. For businesses with a revenue of over $1 billion, turnover must have decreased by 50%. Businesses are then required by law to pay the subsidy to their staff, in lieu of their usual wages. This response came after the enormous job losses seen just a week prior when an estimated 1 million Australians lost their jobs. This massive loss in jobs caused the myGov website to crash and lines out of Centrelink offices to run hundreds of metres long.The program was backdated to 1 March, to aim at reemploying the many people who had just lost their jobs in the weeks before. Businesses would receive the JobKeeper subsidy for six months.Colour photographs of furniture placed for social distancing in the Federation University E.J Barker Library during the Covid-19 Pandemic. The next day the library was closed all except staff.covid-19, corona virus, pandemic, library, e.j. barker library, mt helen library -

Federation University Historical Collection

Federation University Historical CollectionPhotograph, Dana Street, Ballarat During Covid-19 State of Emergency, 13/04/2020

... the first central bank to cut interest rates in response... central bank to cut interest rates in response to the outbreak ...On 12 January, the World Health Organization (WHO) confirmed that a novel coronavirus was the cause of a respiratory illness in a cluster of people in Wuhan City, Hubei Province, China, who had initially come to the attention of the WHO on 31 December 2019. On 3 March, the Reserve Bank of Australia became the first central bank to cut interest rates in response to the outbreak. Official interest rates were cut by 0.25% (25 base points) to a record low of 0.5%. On 12 March, the Federal Government announced a A$17.6 billion stimulus package, the first since the 2008 GFC. he package consists of multiple parts, a one-off A$750 payment to around 6.5 million welfare recipients as early as 31 March 2020, small business assistance with 700,000 grants up to $25,000 and a 50% wage subsidy for 120,000 apprenticies or trainees for up to 9 months, 1 billion to support economically impacted sectors, regions and communities, and $700 million to increase tax write off and $3.2 billion to support short-term small and medium-sized business investment. On 16 March, Premier Dan Andrews and Minister for Health Jenny Mikakos declared a state of emergency for Victoria for at least four weeks. On 19 March, the Reserve Bank again cut interest rates by a further 0.25% to 0.25%, the lowest in Australian history. On 22 March, the government announced a second stimulus package of A$66bn, increasing the amount of total financial package offered to A$89bn. This included several new measures like doubling income support for individuals on Jobseeker's allowance, granting A$100,000 to small and medium-sized businesses and A$715 million to Australian airports and airlines. It also allowed individuals affected by the outbreak to access up to A$10,000 of their superannuation during 2019–2020 and also being able to take an additional same amount for the next year. on the same day Victorian Premier Daniel Andrews announced on 22 March that the state will bring the school holiday forwards to 24 March from 27 March. On 30 March, the Australian Federal Government announced a $130 billion "JobKeeper" wage subsidy program offering to pay employers up to $1500 a fortnight per full-time, part-time or casual employee that has worked for that business for over a year. For a business to be eligible, they must have lost 30% of turnover after 1 March of annual revenue up to and including $1 billion. For businesses with a revenue of over $1 billion, turnover must have decreased by 50%. Businesses are then required by law to pay the subsidy to their staff, in lieu of their usual wages. This response came after the enormous job losses seen just a week prior when an estimated 1 million Australians lost their jobs. This massive loss in jobs caused the myGov website to crash and lines out of Centrelink offices to run hundreds of metres long.The program was backdated to 1 March, to aim at reemploying the many people who had just lost their jobs in the weeks before. Businesses would receive the JobKeeper subsidy for six months. * On 12 April 2020 Victorian Premier Daniel Andrews Extended the State of Emergency until midnight on May 11. On this day the world has 1,604,900 cases of coronavirus, with 95,738 deaths. America has 468,887 cases of covid19, with 1,900 Americans dying in the last 24 hours. The UK has 65,077 cases. 881 people died in the last 24 hours. Australia has 6,292 cases. 58 people have died to date.Colour photographs of Ballarat's usually very busy Dana Street during Covid-19 Social Isoliation. The photographs were taken at 4.00pm. dana street, ballarat, covid19, corona virus, pandemic, state of emergency -

Federation University Historical Collection

Federation University Historical CollectionPhotograph - Photograph - Colour, Eyre Street, Ballarat During Covid-19 State of Emergency, 13/04/2020

... the first central bank to cut interest rates in response... central bank to cut interest rates in response to the outbreak ...On 12 January, the World Health Organization (WHO) confirmed that a novel coronavirus was the cause of a respiratory illness in a cluster of people in Wuhan City, Hubei Province, China, who had initially come to the attention of the WHO on 31 December 2019. On 3 March, the Reserve Bank of Australia became the first central bank to cut interest rates in response to the outbreak. Official interest rates were cut by 0.25% (25 base points) to a record low of 0.5%. On 12 March, the Federal Government announced a A$17.6 billion stimulus package, the first since the 2008 GFC. he package consists of multiple parts, a one-off A$750 payment to around 6.5 million welfare recipients as early as 31 March 2020, small business assistance with 700,000 grants up to $25,000 and a 50% wage subsidy for 120,000 apprenticies or trainees for up to 9 months, 1 billion to support economically impacted sectors, regions and communities, and $700 million to increase tax write off and $3.2 billion to support short-term small and medium-sized business investment. On 16 March, Premier Dan Andrews and Minister for Health Jenny Mikakos declared a state of emergency for Victoria for at least four weeks. On 19 March, the Reserve Bank again cut interest rates by a further 0.25% to 0.25%, the lowest in Australian history. On 22 March, the government announced a second stimulus package of A$66bn, increasing the amount of total financial package offered to A$89bn. This included several new measures like doubling income support for individuals on Jobseeker's allowance, granting A$100,000 to small and medium-sized businesses and A$715 million to Australian airports and airlines. It also allowed individuals affected by the outbreak to access up to A$10,000 of their superannuation during 2019–2020 and also being able to take an additional same amount for the next year. on the same day Victorian Premier Daniel Andrews announced on 22 March that the state will bring the school holiday forwards to 24 March from 27 March. On 30 March, the Australian Federal Government announced a $130 billion "JobKeeper" wage subsidy program offering to pay employers up to $1500 a fortnight per full-time, part-time or casual employee that has worked for that business for over a year. For a business to be eligible, they must have lost 30% of turnover after 1 March of annual revenue up to and including $1 billion. For businesses with a revenue of over $1 billion, turnover must have decreased by 50%. Businesses are then required by law to pay the subsidy to their staff, in lieu of their usual wages. This response came after the enormous job losses seen just a week prior when an estimated 1 million Australians lost their jobs. This massive loss in jobs caused the myGov website to crash and lines out of Centrelink offices to run hundreds of metres long.The program was backdated to 1 March, to aim at reemploying the many people who had just lost their jobs in the weeks before. Businesses would receive the JobKeeper subsidy for six months. * On 12 April 2020 Victorian Premier Daniel Andrews Extended the State of Emergency until midnight on May 11. On this day the world has 1,604,900 cases of coronavirus, with 95,738 deaths. America has 468,887 cases of covid19, with 1,900 Americans dying in the last 24 hours. The UK has 65,077 cases. 881 people died in the last 24 hours. Australia has 6,292 cases. 58 people have died to date.Colour photographs of Ballarat's usually very busy Eyre Street during Covid-19 Social Isoliation. The photographs were taken at 4.00pm. ballarat, covid19, corona virus, pandemic, state of emergency, eyre street -

Federation University Historical Collection

Federation University Historical CollectionPhotograph - Colour, ANZAC Dawn Remembrance During the Covid-19 Pandemic, 2020, 25/04/2020

... the first central bank to cut interest rates in response... central bank to cut interest rates in response to the outbreak ...On 12 January, the World Health Organization (WHO) confirmed that a novel coronavirus was the cause of a respiratory illness in a cluster of people in Wuhan City, Hubei Province, China, who had initially come to the attention of the WHO on 31 December 2019. On 3 March, the Reserve Bank of Australia became the first central bank to cut interest rates in response to the outbreak. Official interest rates were cut by 0.25% (25 base points) to a record low of 0.5%. On 12 March, the Federal Government announced a A$17.6 billion stimulus package, the first since the 2008 GFC. he package consists of multiple parts, a one-off A$750 payment to around 6.5 million welfare recipients as early as 31 March 2020, small business assistance with 700,000 grants up to $25,000 and a 50% wage subsidy for 120,000 apprenticies or trainees for up to 9 months, 1 billion to support economically impacted sectors, regions and communities, and $700 million to increase tax write off and $3.2 billion to support short-term small and medium-sized business investment. On 16 March, Premier Dan Andrews and Minister for Health Jenny Mikakos declared a state of emergency for Victoria for at least four weeks. On 19 March, the Reserve Bank again cut interest rates by a further 0.25% to 0.25%, the lowest in Australian history. On 22 March, the government announced a second stimulus package of A$66bn, increasing the amount of total financial package offered to A$89bn. This included several new measures like doubling income support for individuals on Jobseeker's allowance, granting A$100,000 to small and medium-sized businesses and A$715 million to Australian airports and airlines. It also allowed individuals affected by the outbreak to access up to A$10,000 of their superannuation during 2019–2020 and also being able to take an additional same amount for the next year. on the same day Victorian Premier Daniel Andrews announced on 22 March that the state will bring the school holiday forwards to 24 March from 27 March. On 30 March, the Australian Federal Government announced a $130 billion "JobKeeper" wage subsidy program offering to pay employers up to $1500 a fortnight per full-time, part-time or casual employee that has worked for that business for over a year. For a business to be eligible, they must have lost 30% of turnover after 1 March of annual revenue up to and including $1 billion. For businesses with a revenue of over $1 billion, turnover must have decreased by 50%. Businesses are then required by law to pay the subsidy to their staff, in lieu of their usual wages. This response came after the enormous job losses seen just a week prior when an estimated 1 million Australians lost their jobs. This massive loss in jobs caused the myGov website to crash and lines out of Centrelink offices to run hundreds of metres long.The program was backdated to 1 March, to aim at reemploying the many people who had just lost their jobs in the weeks before. Businesses would receive the JobKeeper subsidy for six months. On 2 April, the number of cases in Victoria exceeded 1,000, including over 100 healthcare workers. On 5 April, New South Wales Police launched a criminal investigation into whether the operator of Ruby Princess, Carnival Australia, broke the Biosecurity Act 2015 (Cwth) and New South Wales state laws, by deliberately concealing COVID-19 cases. On 6 April, the Department of Health revealed that 2,432 people recovered from the infection as the federal government started reporting recovery statistics. This is more than a third from the official number reported so far, Deputy Chief Medical Officer Professor Paul Kelly stating, "I think it is important. Firstly it really reinforces that message, which is a true one, that most people who get this disease do recover”. The day before, at 3pm, it was announced that 2,315 of the 5,687 confirmed coronavirus cases had recovered. May 2020 - An outbreak in Victoria at a meatworks that was later revealed to be Cedar Meats was announced on 02 May with eight cases. By 8 May, the cluster of cases linked to Cedar Meats in Victoria was 71, consisting of at least 57 workers and 13 close contacts, including a nurse, aged care worker and high school student. The number had increased to 75 by 9 May, 88 by 13 May, and 90 by 14 May. On 9 May, two Victorian cases were announced to be related to McDonald's Fawkner. By 18 May, this had increased to 12 cases, and on that day it was revealed that a delivery driver had tested positive, prompting the closing for cleaning of 12 more McDonald's locations: Melton East, Laverton North, Yallambie, Taylors Lakes, Campbellfield, Sunbury, Hoppers Crossing, Riverdale Village, Sandown, Calder Highway Northbound/Outbound, Calder Highway Southbound/Inbound, and BP Rockbank Service Centre Outbound. On 15 May, South Australia became the second jurisdiction, after the ACT, to be free of any active cases, however on 26 May, a woman returning from overseas who was granted exemption into South Australia from her hotel quarantine in Victoria tested positive for COVID-19. This was the first new case in 19 days for the state.[101] On 4 June, it was announced that the woman had recovered and the state was free of any active cases once again.[102] On 17 May, Victoria announced two further business sites had been shut down due to a suspected case at each. Domino's Pizza in Fairfield has been shut for two weeks, and mattress manufacturer The Comfort Group in Deer Park was closed from Friday 15 May to at least Wednesday 20 May. On 6 June, both New South Wales and Victoria reported no new cases for the previous 24 hours, with only Queensland and Western Australia reporting one new case each, the lowest national total since February. Western Australia also announced two old cases. However, the new case in Queensland was linked to the Rydges on Swanston cluster in Melbourne when a man who travelled from Melbourne to Brisbane on Virgin flight VA313 on 1 June tested positive.Colour photographs of an ANZAC dawn remembrance from Armstrong Street South, Ballarat looking East towards Mount Warrenheip. Due to the Covid-19 Pandemic and associated social distancing requirements regular ANZAC Day services and marches could not be held. People were encouraged to remember from their driveways at dawn on 25 April 2020. covid-19, corona virus, pandemic, social distancing, anzac day driveway remembrance, dawn, australian flag, mount warrenheip -

Federation University Historical Collection

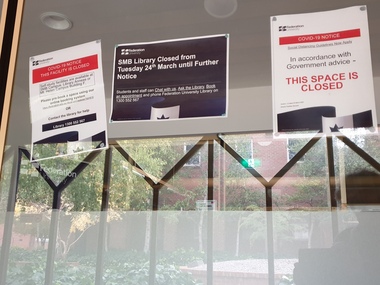

Federation University Historical CollectionPhotograph - Colour, Federation University SMB Campus library Covid 19 Lockdown Notices, 2020, 23/04/2020

... the first central bank to cut interest rates in response... central bank to cut interest rates in response to the outbreak ...On 12 January, the World Health Organization (WHO) confirmed that a novel coronavirus was the cause of a respiratory illness in a cluster of people in Wuhan City, Hubei Province, China, who had initially come to the attention of the WHO on 31 December 2019. On 3 March, the Reserve Bank of Australia became the first central bank to cut interest rates in response to the outbreak. Official interest rates were cut by 0.25% (25 base points) to a record low of 0.5%. On 12 March, the Federal Government announced a A$17.6 billion stimulus package, the first since the 2008 GFC. he package consists of multiple parts, a one-off A$750 payment to around 6.5 million welfare recipients as early as 31 March 2020, small business assistance with 700,000 grants up to $25,000 and a 50% wage subsidy for 120,000 apprenticies or trainees for up to 9 months, 1 billion to support economically impacted sectors, regions and communities, and $700 million to increase tax write off and $3.2 billion to support short-term small and medium-sized business investment. On 16 March, Premier Dan Andrews and Minister for Health Jenny Mikakos declared a state of emergency for Victoria for at least four weeks. On 19 March, the Reserve Bank again cut interest rates by a further 0.25% to 0.25%, the lowest in Australian history. On 22 March, the government announced a second stimulus package of A$66bn, increasing the amount of total financial package offered to A$89bn. This included several new measures like doubling income support for individuals on Jobseeker's allowance, granting A$100,000 to small and medium-sized businesses and A$715 million to Australian airports and airlines. It also allowed individuals affected by the outbreak to access up to A$10,000 of their superannuation during 2019–2020 and also being able to take an additional same amount for the next year. on the same day Victorian Premier Daniel Andrews announced on 22 March that the state will bring the school holiday forwards to 24 March from 27 March. On 30 March, the Australian Federal Government announced a $130 billion "JobKeeper" wage subsidy program offering to pay employers up to $1500 a fortnight per full-time, part-time or casual employee that has worked for that business for over a year. For a business to be eligible, they must have lost 30% of turnover after 1 March of annual revenue up to and including $1 billion. For businesses with a revenue of over $1 billion, turnover must have decreased by 50%. Businesses are then required by law to pay the subsidy to their staff, in lieu of their usual wages. This response came after the enormous job losses seen just a week prior when an estimated 1 million Australians lost their jobs. This massive loss in jobs caused the myGov website to crash and lines out of Centrelink offices to run hundreds of metres long.The program was backdated to 1 March, to aim at reemploying the many people who had just lost their jobs in the weeks before. Businesses would receive the JobKeeper subsidy for six months. On 2 April, the number of cases in Victoria exceeded 1,000, including over 100 healthcare workers. On 5 April, New South Wales Police launched a criminal investigation into whether the operator of Ruby Princess, Carnival Australia, broke the Biosecurity Act 2015 (Cwth) and New South Wales state laws, by deliberately concealing COVID-19 cases. On 6 April, the Department of Health revealed that 2,432 people recovered from the infection as the federal government started reporting recovery statistics. This is more than a third from the official number reported so far, Deputy Chief Medical Officer Professor Paul Kelly stating, "I think it is important. Firstly it really reinforces that message, which is a true one, that most people who get this disease do recover”. The day before, at 3pm, it was announced that 2,315 of the 5,687 confirmed coronavirus cases had recovered. May 2020 - An outbreak in Victoria at a meatworks that was later revealed to be Cedar Meats was announced on 02 May with eight cases. By 8 May, the cluster of cases linked to Cedar Meats in Victoria was 71, consisting of at least 57 workers and 13 close contacts, including a nurse, aged care worker and high school student. The number had increased to 75 by 9 May, 88 by 13 May, and 90 by 14 May. On 9 May, two Victorian cases were announced to be related to McDonald's Fawkner. By 18 May, this had increased to 12 cases, and on that day it was revealed that a delivery driver had tested positive, prompting the closing for cleaning of 12 more McDonald's locations: Melton East, Laverton North, Yallambie, Taylors Lakes, Campbellfield, Sunbury, Hoppers Crossing, Riverdale Village, Sandown, Calder Highway Northbound/Outbound, Calder Highway Southbound/Inbound, and BP Rockbank Service Centre Outbound. On 15 May, South Australia became the second jurisdiction, after the ACT, to be free of any active cases, however on 26 May, a woman returning from overseas who was granted exemption into South Australia from her hotel quarantine in Victoria tested positive for COVID-19. This was the first new case in 19 days for the state.[101] On 4 June, it was announced that the woman had recovered and the state was free of any active cases once again.[102] On 17 May, Victoria announced two further business sites had been shut down due to a suspected case at each. Domino's Pizza in Fairfield has been shut for two weeks, and mattress manufacturer The Comfort Group in Deer Park was closed from Friday 15 May to at least Wednesday 20 May. On 6 June, both New South Wales and Victoria reported no new cases for the previous 24 hours, with only Queensland and Western Australia reporting one new case each, the lowest national total since February. Western Australia also announced two old cases. However, the new case in Queensland was linked to the Rydges on Swanston cluster in Melbourne when a man who travelled from Melbourne to Brisbane on Virgin flight VA313 on 1 June tested positive.Colour photographs of closure signs on the E.J Tippett Library due to the Covid-19 Pandemic and associated lock down and social distancing requirements.covid-19, corona virus, pandemic, social distancing, ballarat school of mines, e.j. tippett library, lock down -

Federation University Historical Collection

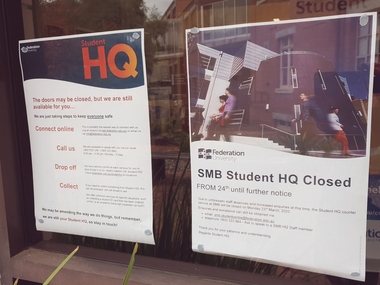

Federation University Historical CollectionPhotograph - Colour, Federation University SMB Campus Student HQ Covid 19 Closure Notices, 2020, 23/04/2020

... the first central bank to cut interest rates in response... central bank to cut interest rates in response to the outbreak ...On 12 January, the World Health Organization (WHO) confirmed that a novel coronavirus was the cause of a respiratory illness in a cluster of people in Wuhan City, Hubei Province, China, who had initially come to the attention of the WHO on 31 December 2019. On 3 March, the Reserve Bank of Australia became the first central bank to cut interest rates in response to the outbreak. Official interest rates were cut by 0.25% (25 base points) to a record low of 0.5%. On 12 March, the Federal Government announced a A$17.6 billion stimulus package, the first since the 2008 GFC. he package consists of multiple parts, a one-off A$750 payment to around 6.5 million welfare recipients as early as 31 March 2020, small business assistance with 700,000 grants up to $25,000 and a 50% wage subsidy for 120,000 apprenticies or trainees for up to 9 months, 1 billion to support economically impacted sectors, regions and communities, and $700 million to increase tax write off and $3.2 billion to support short-term small and medium-sized business investment. On 16 March, Premier Dan Andrews and Minister for Health Jenny Mikakos declared a state of emergency for Victoria for at least four weeks. On 19 March, the Reserve Bank again cut interest rates by a further 0.25% to 0.25%, the lowest in Australian history. On 22 March, the government announced a second stimulus package of A$66bn, increasing the amount of total financial package offered to A$89bn. This included several new measures like doubling income support for individuals on Jobseeker's allowance, granting A$100,000 to small and medium-sized businesses and A$715 million to Australian airports and airlines. It also allowed individuals affected by the outbreak to access up to A$10,000 of their superannuation during 2019–2020 and also being able to take an additional same amount for the next year. on the same day Victorian Premier Daniel Andrews announced on 22 March that the state will bring the school holiday forwards to 24 March from 27 March. On 30 March, the Australian Federal Government announced a $130 billion "JobKeeper" wage subsidy program offering to pay employers up to $1500 a fortnight per full-time, part-time or casual employee that has worked for that business for over a year. For a business to be eligible, they must have lost 30% of turnover after 1 March of annual revenue up to and including $1 billion. For businesses with a revenue of over $1 billion, turnover must have decreased by 50%. Businesses are then required by law to pay the subsidy to their staff, in lieu of their usual wages. This response came after the enormous job losses seen just a week prior when an estimated 1 million Australians lost their jobs. This massive loss in jobs caused the myGov website to crash and lines out of Centrelink offices to run hundreds of metres long.The program was backdated to 1 March, to aim at reemploying the many people who had just lost their jobs in the weeks before. Businesses would receive the JobKeeper subsidy for six months. On 2 April, the number of cases in Victoria exceeded 1,000, including over 100 healthcare workers. On 5 April, New South Wales Police launched a criminal investigation into whether the operator of Ruby Princess, Carnival Australia, broke the Biosecurity Act 2015 (Cwth) and New South Wales state laws, by deliberately concealing COVID-19 cases. On 6 April, the Department of Health revealed that 2,432 people recovered from the infection as the federal government started reporting recovery statistics. This is more than a third from the official number reported so far, Deputy Chief Medical Officer Professor Paul Kelly stating, "I think it is important. Firstly it really reinforces that message, which is a true one, that most people who get this disease do recover”. The day before, at 3pm, it was announced that 2,315 of the 5,687 confirmed coronavirus cases had recovered. May 2020 - An outbreak in Victoria at a meatworks that was later revealed to be Cedar Meats was announced on 02 May with eight cases. By 8 May, the cluster of cases linked to Cedar Meats in Victoria was 71, consisting of at least 57 workers and 13 close contacts, including a nurse, aged care worker and high school student. The number had increased to 75 by 9 May, 88 by 13 May, and 90 by 14 May. On 9 May, two Victorian cases were announced to be related to McDonald's Fawkner. By 18 May, this had increased to 12 cases, and on that day it was revealed that a delivery driver had tested positive, prompting the closing for cleaning of 12 more McDonald's locations: Melton East, Laverton North, Yallambie, Taylors Lakes, Campbellfield, Sunbury, Hoppers Crossing, Riverdale Village, Sandown, Calder Highway Northbound/Outbound, Calder Highway Southbound/Inbound, and BP Rockbank Service Centre Outbound. On 15 May, South Australia became the second jurisdiction, after the ACT, to be free of any active cases, however on 26 May, a woman returning from overseas who was granted exemption into South Australia from her hotel quarantine in Victoria tested positive for COVID-19. This was the first new case in 19 days for the state.[101] On 4 June, it was announced that the woman had recovered and the state was free of any active cases once again.[102] On 17 May, Victoria announced two further business sites had been shut down due to a suspected case at each. Domino's Pizza in Fairfield has been shut for two weeks, and mattress manufacturer The Comfort Group in Deer Park was closed from Friday 15 May to at least Wednesday 20 May. On 6 June, both New South Wales and Victoria reported no new cases for the previous 24 hours, with only Queensland and Western Australia reporting one new case each, the lowest national total since February. Western Australia also announced two old cases. However, the new case in Queensland was linked to the Rydges on Swanston cluster in Melbourne when a man who travelled from Melbourne to Brisbane on Virgin flight VA313 on 1 June tested positive.Colour photographs of closure signs on the E.J Tippett Library due to the Covid-19 Pandemic and associated lock down and social distancing requirements.covid-19, corona virus, pandemic, social distancing, ballarat school of mines, e.j. tippett library, lock down -

Federation University Historical Collection

Federation University Historical CollectionDocument - Documents, Federation University Notifications Referring to Covid-19, 2020, 06/04/2020

... the first central bank to cut interest rates in response... central bank to cut interest rates in response to the outbreak ...On 12 January, the World Health Organization (WHO) confirmed that a novel coronavirus was the cause of a respiratory illness in a cluster of people in Wuhan City, Hubei Province, China, who had initially come to the attention of the WHO on 31 December 2019. On 3 March, the Reserve Bank of Australia became the first central bank to cut interest rates in response to the outbreak. Official interest rates were cut by 0.25% (25 base points) to a record low of 0.5%. On 12 March, the Federal Government announced a A$17.6 billion stimulus package, the first since the 2008 GFC. he package consists of multiple parts, a one-off A$750 payment to around 6.5 million welfare recipients as early as 31 March 2020, small business assistance with 700,000 grants up to $25,000 and a 50% wage subsidy for 120,000 apprenticies or trainees for up to 9 months, 1 billion to support economically impacted sectors, regions and communities, and $700 million to increase tax write off and $3.2 billion to support short-term small and medium-sized business investment. On 16 March, Premier Dan Andrews and Minister for Health Jenny Mikakos declared a state of emergency for Victoria for at least four weeks. On 19 March, the Reserve Bank again cut interest rates by a further 0.25% to 0.25%, the lowest in Australian history. On 22 March, the government announced a second stimulus package of A$66bn, increasing the amount of total financial package offered to A$89bn. This included several new measures like doubling income support for individuals on Jobseeker's allowance, granting A$100,000 to small and medium-sized businesses and A$715 million to Australian airports and airlines. It also allowed individuals affected by the outbreak to access up to A$10,000 of their superannuation during 2019–2020 and also being able to take an additional same amount for the next year. on the same day Victorian Premier Daniel Andrews announced on 22 March that the state will bring the school holiday forwards to 24 March from 27 March. On 30 March, the Australian Federal Government announced a $130 billion "JobKeeper" wage subsidy program offering to pay employers up to $1500 a fortnight per full-time, part-time or casual employee that has worked for that business for over a year. For a business to be eligible, they must have lost 30% of turnover after 1 March of annual revenue up to and including $1 billion. For businesses with a revenue of over $1 billion, turnover must have decreased by 50%. Businesses are then required by law to pay the subsidy to their staff, in lieu of their usual wages. This response came after the enormous job losses seen just a week prior when an estimated 1 million Australians lost their jobs. This massive loss in jobs caused the myGov website to crash and lines out of Centrelink offices to run hundreds of metres long.The program was backdated to 1 March, to aim at reemploying the many people who had just lost their jobs in the weeks before. Businesses would receive the JobKeeper subsidy for six months. On 2 April, the number of cases in Victoria exceeded 1,000, including over 100 healthcare workers. On 5 April, New South Wales Police launched a criminal investigation into whether the operator of Ruby Princess, Carnival Australia, broke the Biosecurity Act 2015 (Cwth) and New South Wales state laws, by deliberately concealing COVID-19 cases. On 6 April, the Department of Health revealed that 2,432 people recovered from the infection as the federal government started reporting recovery statistics. This is more than a third from the official number reported so far, Deputy Chief Medical Officer Professor Paul Kelly stating, "I think it is important. Firstly it really reinforces that message, which is a true one, that most people who get this disease do recover”. The day before, at 3pm, it was announced that 2,315 of the 5,687 confirmed coronavirus cases had recovered. May 2020 - An outbreak in Victoria at a meatworks that was later revealed to be Cedar Meats was announced on 02 May with eight cases. By 8 May, the cluster of cases linked to Cedar Meats in Victoria was 71, consisting of at least 57 workers and 13 close contacts, including a nurse, aged care worker and high school student. The number had increased to 75 by 9 May, 88 by 13 May, and 90 by 14 May. On 9 May, two Victorian cases were announced to be related to McDonald's Fawkner. By 18 May, this had increased to 12 cases, and on that day it was revealed that a delivery driver had tested positive, prompting the closing for cleaning of 12 more McDonald's locations: Melton East, Laverton North, Yallambie, Taylors Lakes, Campbellfield, Sunbury, Hoppers Crossing, Riverdale Village, Sandown, Calder Highway Northbound/Outbound, Calder Highway Southbound/Inbound, and BP Rockbank Service Centre Outbound. On 15 May, South Australia became the second jurisdiction, after the ACT, to be free of any active cases, however on 26 May, a woman returning from overseas who was granted exemption into South Australia from her hotel quarantine in Victoria tested positive for COVID-19. This was the first new case in 19 days for the state.[101] On 4 June, it was announced that the woman had recovered and the state was free of any active cases once again.[102] On 17 May, Victoria announced two further business sites had been shut down due to a suspected case at each. Domino's Pizza in Fairfield has been shut for two weeks, and mattress manufacturer The Comfort Group in Deer Park was closed from Friday 15 May to at least Wednesday 20 May. On 6 June, both New South Wales and Victoria reported no new cases for the previous 24 hours, with only Queensland and Western Australia reporting one new case each, the lowest national total since February. Western Australia also announced two old cases. However, the new case in Queensland was linked to the Rydges on Swanston cluster in Melbourne when a man who travelled from Melbourne to Brisbane on Virgin flight VA313 on 1 June tested positive.Notifications to staff and students relating to the worldwide Covid-19 Pandemic. * Federation University COVIDSafe Plan prepared by the Transition to Campus Control Group, Version 1.4, 21 July 2020 * Federation University Notifications Referring to Covid-19, 18 August 2020covid-19, corona virus, pandemic, social distancing, lock down, federation university australia, covidsafe plan -

Federation University Historical Collection

Federation University Historical CollectionDocument, Federation University Coronavirus - Advice for staff and students, 17/05/2021

... the first central bank to cut interest rates in response... central bank to cut interest rates in response to the outbreak ...On 12 January, the World Health Organization (WHO) confirmed that a novel coronavirus was the cause of a respiratory illness in a cluster of people in Wuhan City, Hubei Province, China, who had initially come to the attention of the WHO on 31 December 2019. On 3 March, the Reserve Bank of Australia became the first central bank to cut interest rates in response to the outbreak. Official interest rates were cut by 0.25% (25 base points) to a record low of 0.5%. On 12 March, the Federal Government announced a A$17.6 billion stimulus package, the first since the 2008 GFC. he package consists of multiple parts, a one-off A$750 payment to around 6.5 million welfare recipients as early as 31 March 2020, small business assistance with 700,000 grants up to $25,000 and a 50% wage subsidy for 120,000 apprenticies or trainees for up to 9 months, 1 billion to support economically impacted sectors, regions and communities, and $700 million to increase tax write off and $3.2 billion to support short-term small and medium-sized business investment. On 16 March, Premier Dan Andrews and Minister for Health Jenny Mikakos declared a state of emergency for Victoria for at least four weeks. On 19 March, the Reserve Bank again cut interest rates by a further 0.25% to 0.25%, the lowest in Australian history. On 22 March, the government announced a second stimulus package of A$66bn, increasing the amount of total financial package offered to A$89bn. This included several new measures like doubling income support for individuals on Jobseeker's allowance, granting A$100,000 to small and medium-sized businesses and A$715 million to Australian airports and airlines. It also allowed individuals affected by the outbreak to access up to A$10,000 of their superannuation during 2019–2020 and also being able to take an additional same amount for the next year. on the same day Victorian Premier Daniel Andrews announced on 22 March that the state will bring the school holiday forwards to 24 March from 27 March. On 30 March, the Australian Federal Government announced a $130 billion "JobKeeper" wage subsidy program offering to pay employers up to $1500 a fortnight per full-time, part-time or casual employee that has worked for that business for over a year. For a business to be eligible, they must have lost 30% of turnover after 1 March of annual revenue up to and including $1 billion. For businesses with a revenue of over $1 billion, turnover must have decreased by 50%. Businesses are then required by law to pay the subsidy to their staff, in lieu of their usual wages. This response came after the enormous job losses seen just a week prior when an estimated 1 million Australians lost their jobs. This massive loss in jobs caused the myGov website to crash and lines out of Centrelink offices to run hundreds of metres long.The program was backdated to 1 March, to aim at reemploying the many people who had just lost their jobs in the weeks before. Businesses would receive the JobKeeper subsidy for six months. On 2 April, the number of cases in Victoria exceeded 1,000, including over 100 healthcare workers. On 5 April, New South Wales Police launched a criminal investigation into whether the operator of Ruby Princess, Carnival Australia, broke the Biosecurity Act 2015 (Cwth) and New South Wales state laws, by deliberately concealing COVID-19 cases. On 6 April, the Department of Health revealed that 2,432 people recovered from the infection as the federal government started reporting recovery statistics. This is more than a third from the official number reported so far, Deputy Chief Medical Officer Professor Paul Kelly stating, "I think it is important. Firstly it really reinforces that message, which is a true one, that most people who get this disease do recover”. The day before, at 3pm, it was announced that 2,315 of the 5,687 confirmed coronavirus cases had recovered. May 2020 - An outbreak in Victoria at a meatworks that was later revealed to be Cedar Meats was announced on 02 May with eight cases. By 8 May, the cluster of cases linked to Cedar Meats in Victoria was 71, consisting of at least 57 workers and 13 close contacts, including a nurse, aged care worker and high school student. The number had increased to 75 by 9 May, 88 by 13 May, and 90 by 14 May. On 9 May, two Victorian cases were announced to be related to McDonald's Fawkner. By 18 May, this had increased to 12 cases, and on that day it was revealed that a delivery driver had tested positive, prompting the closing for cleaning of 12 more McDonald's locations: Melton East, Laverton North, Yallambie, Taylors Lakes, Campbellfield, Sunbury, Hoppers Crossing, Riverdale Village, Sandown, Calder Highway Northbound/Outbound, Calder Highway Southbound/Inbound, and BP Rockbank Service Centre Outbound. On 15 May, South Australia became the second jurisdiction, after the ACT, to be free of any active cases, however on 26 May, a woman returning from overseas who was granted exemption into South Australia from her hotel quarantine in Victoria tested positive for COVID-19. This was the first new case in 19 days for the state.[101] On 4 June, it was announced that the woman had recovered and the state was free of any active cases once again.[102] On 17 May, Victoria announced two further business sites had been shut down due to a suspected case at each. Domino's Pizza in Fairfield has been shut for two weeks, and mattress manufacturer The Comfort Group in Deer Park was closed from Friday 15 May to at least Wednesday 20 May. On 6 June, both New South Wales and Victoria reported no new cases for the previous 24 hours, with only Queensland and Western Australia reporting one new case each, the lowest national total since February. Western Australia also announced two old cases. However, the new case in Queensland was linked to the Rydges on Swanston cluster in Melbourne when a man who travelled from Melbourne to Brisbane on Virgin flight VA313 on 1 June tested positive.Printout of a webspage designed to guide staff and students through the COVID-19 pandemic. covid-19, corona virus, pandemic, federation university australia, covidsafe plan, response -

Federation University Historical Collection

Federation University Historical CollectionDocument, Federation University CovidSafe Plan, 17/05/2021

... the first central bank to cut interest rates in response... central bank to cut interest rates in response to the outbreak ...On 12 January, the World Health Organization (WHO) confirmed that a novel coronavirus was the cause of a respiratory illness in a cluster of people in Wuhan City, Hubei Province, China, who had initially come to the attention of the WHO on 31 December 2019. On 3 March, the Reserve Bank of Australia became the first central bank to cut interest rates in response to the outbreak. Official interest rates were cut by 0.25% (25 base points) to a record low of 0.5%. On 12 March, the Federal Government announced a A$17.6 billion stimulus package, the first since the 2008 GFC. he package consists of multiple parts, a one-off A$750 payment to around 6.5 million welfare recipients as early as 31 March 2020, small business assistance with 700,000 grants up to $25,000 and a 50% wage subsidy for 120,000 apprenticies or trainees for up to 9 months, 1 billion to support economically impacted sectors, regions and communities, and $700 million to increase tax write off and $3.2 billion to support short-term small and medium-sized business investment. On 16 March, Premier Dan Andrews and Minister for Health Jenny Mikakos declared a state of emergency for Victoria for at least four weeks. On 19 March, the Reserve Bank again cut interest rates by a further 0.25% to 0.25%, the lowest in Australian history. On 22 March, the government announced a second stimulus package of A$66bn, increasing the amount of total financial package offered to A$89bn. This included several new measures like doubling income support for individuals on Jobseeker's allowance, granting A$100,000 to small and medium-sized businesses and A$715 million to Australian airports and airlines. It also allowed individuals affected by the outbreak to access up to A$10,000 of their superannuation during 2019–2020 and also being able to take an additional same amount for the next year. on the same day Victorian Premier Daniel Andrews announced on 22 March that the state will bring the school holiday forwards to 24 March from 27 March. On 30 March, the Australian Federal Government announced a $130 billion "JobKeeper" wage subsidy program offering to pay employers up to $1500 a fortnight per full-time, part-time or casual employee that has worked for that business for over a year. For a business to be eligible, they must have lost 30% of turnover after 1 March of annual revenue up to and including $1 billion. For businesses with a revenue of over $1 billion, turnover must have decreased by 50%. Businesses are then required by law to pay the subsidy to their staff, in lieu of their usual wages. This response came after the enormous job losses seen just a week prior when an estimated 1 million Australians lost their jobs. This massive loss in jobs caused the myGov website to crash and lines out of Centrelink offices to run hundreds of metres long.The program was backdated to 1 March, to aim at reemploying the many people who had just lost their jobs in the weeks before. Businesses would receive the JobKeeper subsidy for six months. On 2 April, the number of cases in Victoria exceeded 1,000, including over 100 healthcare workers. On 5 April, New South Wales Police launched a criminal investigation into whether the operator of Ruby Princess, Carnival Australia, broke the Biosecurity Act 2015 (Cwth) and New South Wales state laws, by deliberately concealing COVID-19 cases. On 6 April, the Department of Health revealed that 2,432 people recovered from the infection as the federal government started reporting recovery statistics. This is more than a third from the official number reported so far, Deputy Chief Medical Officer Professor Paul Kelly stating, "I think it is important. Firstly it really reinforces that message, which is a true one, that most people who get this disease do recover”. The day before, at 3pm, it was announced that 2,315 of the 5,687 confirmed coronavirus cases had recovered. May 2020 - An outbreak in Victoria at a meatworks that was later revealed to be Cedar Meats was announced on 02 May with eight cases. By 8 May, the cluster of cases linked to Cedar Meats in Victoria was 71, consisting of at least 57 workers and 13 close contacts, including a nurse, aged care worker and high school student. The number had increased to 75 by 9 May, 88 by 13 May, and 90 by 14 May. On 9 May, two Victorian cases were announced to be related to McDonald's Fawkner. By 18 May, this had increased to 12 cases, and on that day it was revealed that a delivery driver had tested positive, prompting the closing for cleaning of 12 more McDonald's locations: Melton East, Laverton North, Yallambie, Taylors Lakes, Campbellfield, Sunbury, Hoppers Crossing, Riverdale Village, Sandown, Calder Highway Northbound/Outbound, Calder Highway Southbound/Inbound, and BP Rockbank Service Centre Outbound. On 15 May, South Australia became the second jurisdiction, after the ACT, to be free of any active cases, however on 26 May, a woman returning from overseas who was granted exemption into South Australia from her hotel quarantine in Victoria tested positive for COVID-19. This was the first new case in 19 days for the state.[101] On 4 June, it was announced that the woman had recovered and the state was free of any active cases once again.[102] On 17 May, Victoria announced two further business sites had been shut down due to a suspected case at each. Domino's Pizza in Fairfield has been shut for two weeks, and mattress manufacturer The Comfort Group in Deer Park was closed from Friday 15 May to at least Wednesday 20 May. On 6 June, both New South Wales and Victoria reported no new cases for the previous 24 hours, with only Queensland and Western Australia reporting one new case each, the lowest national total since February. Western Australia also announced two old cases. However, the new case in Queensland was linked to the Rydges on Swanston cluster in Melbourne when a man who travelled from Melbourne to Brisbane on Virgin flight VA313 on 1 June tested positive.Printout of a webpage designed to guide staff and students through the COVID-19 pandemic. covid-19, corona virus, pandemic, federation university australia, covidsafe plan, response -

Federation University Historical Collection

Federation University Historical CollectionDocument, Federation University Coronavirus Updates, 2020-2021, 17/05/2021

... the first central bank to cut interest rates in response... central bank to cut interest rates in response to the outbreak ...On 12 January, the World Health Organization (WHO) confirmed that a novel coronavirus was the cause of a respiratory illness in a cluster of people in Wuhan City, Hubei Province, China, who had initially come to the attention of the WHO on 31 December 2019. On 3 March, the Reserve Bank of Australia became the first central bank to cut interest rates in response to the outbreak. Official interest rates were cut by 0.25% (25 base points) to a record low of 0.5%. On 12 March, the Federal Government announced a A$17.6 billion stimulus package, the first since the 2008 GFC. he package consists of multiple parts, a one-off A$750 payment to around 6.5 million welfare recipients as early as 31 March 2020, small business assistance with 700,000 grants up to $25,000 and a 50% wage subsidy for 120,000 apprenticies or trainees for up to 9 months, 1 billion to support economically impacted sectors, regions and communities, and $700 million to increase tax write off and $3.2 billion to support short-term small and medium-sized business investment. On 16 March, Premier Dan Andrews and Minister for Health Jenny Mikakos declared a state of emergency for Victoria for at least four weeks. On 19 March, the Reserve Bank again cut interest rates by a further 0.25% to 0.25%, the lowest in Australian history. On 22 March, the government announced a second stimulus package of A$66bn, increasing the amount of total financial package offered to A$89bn. This included several new measures like doubling income support for individuals on Jobseeker's allowance, granting A$100,000 to small and medium-sized businesses and A$715 million to Australian airports and airlines. It also allowed individuals affected by the outbreak to access up to A$10,000 of their superannuation during 2019–2020 and also being able to take an additional same amount for the next year. on the same day Victorian Premier Daniel Andrews announced on 22 March that the state will bring the school holiday forwards to 24 March from 27 March. On 30 March, the Australian Federal Government announced a $130 billion "JobKeeper" wage subsidy program offering to pay employers up to $1500 a fortnight per full-time, part-time or casual employee that has worked for that business for over a year. For a business to be eligible, they must have lost 30% of turnover after 1 March of annual revenue up to and including $1 billion. For businesses with a revenue of over $1 billion, turnover must have decreased by 50%. Businesses are then required by law to pay the subsidy to their staff, in lieu of their usual wages. This response came after the enormous job losses seen just a week prior when an estimated 1 million Australians lost their jobs. This massive loss in jobs caused the myGov website to crash and lines out of Centrelink offices to run hundreds of metres long.The program was backdated to 1 March, to aim at reemploying the many people who had just lost their jobs in the weeks before. Businesses would receive the JobKeeper subsidy for six months. On 2 April, the number of cases in Victoria exceeded 1,000, including over 100 healthcare workers. On 5 April, New South Wales Police launched a criminal investigation into whether the operator of Ruby Princess, Carnival Australia, broke the Biosecurity Act 2015 (Cwth) and New South Wales state laws, by deliberately concealing COVID-19 cases. On 6 April, the Department of Health revealed that 2,432 people recovered from the infection as the federal government started reporting recovery statistics. This is more than a third from the official number reported so far, Deputy Chief Medical Officer Professor Paul Kelly stating, "I think it is important. Firstly it really reinforces that message, which is a true one, that most people who get this disease do recover”. The day before, at 3pm, it was announced that 2,315 of the 5,687 confirmed coronavirus cases had recovered. May 2020 - An outbreak in Victoria at a meatworks that was later revealed to be Cedar Meats was announced on 02 May with eight cases. By 8 May, the cluster of cases linked to Cedar Meats in Victoria was 71, consisting of at least 57 workers and 13 close contacts, including a nurse, aged care worker and high school student. The number had increased to 75 by 9 May, 88 by 13 May, and 90 by 14 May. On 9 May, two Victorian cases were announced to be related to McDonald's Fawkner. By 18 May, this had increased to 12 cases, and on that day it was revealed that a delivery driver had tested positive, prompting the closing for cleaning of 12 more McDonald's locations: Melton East, Laverton North, Yallambie, Taylors Lakes, Campbellfield, Sunbury, Hoppers Crossing, Riverdale Village, Sandown, Calder Highway Northbound/Outbound, Calder Highway Southbound/Inbound, and BP Rockbank Service Centre Outbound. On 15 May, South Australia became the second jurisdiction, after the ACT, to be free of any active cases, however on 26 May, a woman returning from overseas who was granted exemption into South Australia from her hotel quarantine in Victoria tested positive for COVID-19. This was the first new case in 19 days for the state.[101] On 4 June, it was announced that the woman had recovered and the state was free of any active cases once again.[102] On 17 May, Victoria announced two further business sites had been shut down due to a suspected case at each. Domino's Pizza in Fairfield has been shut for two weeks, and mattress manufacturer The Comfort Group in Deer Park was closed from Friday 15 May to at least Wednesday 20 May. On 6 June, both New South Wales and Victoria reported no new cases for the previous 24 hours, with only Queensland and Western Australia reporting one new case each, the lowest national total since February. Western Australia also announced two old cases. However, the new case in Queensland was linked to the Rydges on Swanston cluster in Melbourne when a man who travelled from Melbourne to Brisbane on Virgin flight VA313 on 1 June tested positive.Printout of a number of regular Coronavirus updates that were distributed during the Covid-19 Pandemic. covid-19, corona virus, pandemic, federation university australia, covidsafe plan, response, face masks, blended workfore, lock down, office capacity, gatherings, physical distancing, social distancing, cotact tracing, exams, safe start on campus, transition to campus, employee assistance program -

Federation University Historical Collection

Federation University Historical CollectionDocument - Documents, Australian Government Covid-19 Vaccination Booster Dose information, 19/08/2020

... the first central bank to cut interest rates in response... central bank to cut interest rates in response to the outbreak ...On 12 January, the World Health Organization (WHO) confirmed that a novel coronavirus was the cause of a respiratory illness in a cluster of people in Wuhan City, Hubei Province, China, who had initially come to the attention of the WHO on 31 December 2019. On 3 March, the Reserve Bank of Australia became the first central bank to cut interest rates in response to the outbreak. Official interest rates were cut by 0.25% (25 base points) to a record low of 0.5%. On 12 March, the Federal Government announced a A$17.6 billion stimulus package, the first since the 2008 GFC. he package consists of multiple parts, a one-off A$750 payment to around 6.5 million welfare recipients as early as 31 March 2020, small business assistance with 700,000 grants up to $25,000 and a 50% wage subsidy for 120,000 apprenticies or trainees for up to 9 months, 1 billion to support economically impacted sectors, regions and communities, and $700 million to increase tax write off and $3.2 billion to support short-term small and medium-sized business investment. On 16 March, Premier Dan Andrews and Minister for Health Jenny Mikakos declared a state of emergency for Victoria for at least four weeks. On 19 March, the Reserve Bank again cut interest rates by a further 0.25% to 0.25%, the lowest in Australian history. On 22 March, the government announced a second stimulus package of A$66bn, increasing the amount of total financial package offered to A$89bn. This included several new measures like doubling income support for individuals on Jobseeker's allowance, granting A$100,000 to small and medium-sized businesses and A$715 million to Australian airports and airlines. It also allowed individuals affected by the outbreak to access up to A$10,000 of their superannuation during 2019–2020 and also being able to take an additional same amount for the next year. on the same day Victorian Premier Daniel Andrews announced on 22 March that the state will bring the school holiday forwards to 24 March from 27 March. On 30 March, the Australian Federal Government announced a $130 billion "JobKeeper" wage subsidy program offering to pay employers up to $1500 a fortnight per full-time, part-time or casual employee that has worked for that business for over a year. For a business to be eligible, they must have lost 30% of turnover after 1 March of annual revenue up to and including $1 billion. For businesses with a revenue of over $1 billion, turnover must have decreased by 50%. Businesses are then required by law to pay the subsidy to their staff, in lieu of their usual wages. This response came after the enormous job losses seen just a week prior when an estimated 1 million Australians lost their jobs. This massive loss in jobs caused the myGov website to crash and lines out of Centrelink offices to run hundreds of metres long.The program was backdated to 1 March, to aim at reemploying the many people who had just lost their jobs in the weeks before. Businesses would receive the JobKeeper subsidy for six months. On 2 April, the number of cases in Victoria exceeded 1,000, including over 100 healthcare workers. On 5 April, New South Wales Police launched a criminal investigation into whether the operator of Ruby Princess, Carnival Australia, broke the Biosecurity Act 2015 (Cwth) and New South Wales state laws, by deliberately concealing COVID-19 cases. On 6 April, the Department of Health revealed that 2,432 people recovered from the infection as the federal government started reporting recovery statistics. This is more than a third from the official number reported so far, Deputy Chief Medical Officer Professor Paul Kelly stating, "I think it is important. Firstly it really reinforces that message, which is a true one, that most people who get this disease do recover”. The day before, at 3pm, it was announced that 2,315 of the 5,687 confirmed coronavirus cases had recovered. May 2020 - An outbreak in Victoria at a meatworks that was later revealed to be Cedar Meats was announced on 02 May with eight cases. By 8 May, the cluster of cases linked to Cedar Meats in Victoria was 71, consisting of at least 57 workers and 13 close contacts, including a nurse, aged care worker and high school student. The number had increased to 75 by 9 May, 88 by 13 May, and 90 by 14 May. On 9 May, two Victorian cases were announced to be related to McDonald's Fawkner. By 18 May, this had increased to 12 cases, and on that day it was revealed that a delivery driver had tested positive, prompting the closing for cleaning of 12 more McDonald's locations: Melton East, Laverton North, Yallambie, Taylors Lakes, Campbellfield, Sunbury, Hoppers Crossing, Riverdale Village, Sandown, Calder Highway Northbound/Outbound, Calder Highway Southbound/Inbound, and BP Rockbank Service Centre Outbound. On 15 May, South Australia became the second jurisdiction, after the ACT, to be free of any active cases, however on 26 May, a woman returning from overseas who was granted exemption into South Australia from her hotel quarantine in Victoria tested positive for COVID-19. This was the first new case in 19 days for the state.[101] On 4 June, it was announced that the woman had recovered and the state was free of any active cases once again.[102] On 17 May, Victoria announced two further business sites had been shut down due to a suspected case at each. Domino's Pizza in Fairfield has been shut for two weeks, and mattress manufacturer The Comfort Group in Deer Park was closed from Friday 15 May to at least Wednesday 20 May. On 6 June, both New South Wales and Victoria reported no new cases for the previous 24 hours, with only Queensland and Western Australia reporting one new case each, the lowest national total since February. Western Australia also announced two old cases. However, the new case in Queensland was linked to the Rydges on Swanston cluster in Melbourne when a man who travelled from Melbourne to Brisbane on Virgin flight VA313 on 1 June tested positive.An A4 printed document persented to those who received a Covid19 Vaccination boostercovid-19, corona virus, pandemic, social distancing, lock down, vaccine, vaccine booster -

National Wool Museum